It’s not about money, it’s about LIFE

Taking a first step to the rest of your financial lives…

“… A journey of a thousand miles begins with a single step…”

Lao Tzu

AGENDA

day 1

- Introduction:

- What is MONEY FLOW, MONEY GROW, MONEY PRO®

- Stages of life

- How does money affect all areas of my life?

- Statistics

- Why am I here today?

- My Financial Plan:

- What is a Financial Plan?

- ABC

- 5 Rules

- First block of my Financial Plan: MONEY FLOW®

- Step 1: My financial goals

- Step 2: My current situation

- Step 3: My budget

- Step 4: Design of a simple plan

- Step 5: Automatization

- Charity

- Why it should be part of my Financial Plan

- Charity Idea #1

- Smart habits

- Commitment

- Conclusions day 1

- Homework

MONEY FLOW ®

INTRODUCTION

- It is an educational program that covers all financial aspects of our lives, including the organization, growth and protection of our assets.

- It is organized into three blocks and four sessions.

- Its objective is to make a lasting impact in people’s lives and help them set a foundation to achieve their personal and family goals.

MONEY grOW®

2

- How do I make my money GROW?

- Understanding financial principles

- Identifying my risk profile and investment goals

- Investing in financial markets

- Investing for Retirement

- Investing in Real Estate

- Investing in a new business

- Staying informed: How economics and politics affect my financial decisions

MONEY FLOW®

1

- What is a Financial Plan and why we need it for our lives?

- First five steps of my Financial Plan:

- Step 1: My financial goals

- Step 2: My current situation

- Step 3: My budget - My FLOW

- Step 4: Design of a simple plan

- Step 5: Automatization

- Charity: Why it should be part of my Financial Plan

- Smart habits

- Commitment

MONEY pro®

3

- How do I PROTECT my money?

- Risk management and planning: Insurance

- Tax planning: fundamental concepts

- Estate planning: what will happen with my assets?

- Protecting my identity

- Getting organized: Filing and storage guides

- Commitment

MONEY FLOW ®

Life Stages

Entering workforce -early career years

Financial goals, credit history, investments and retirement accounts, health insurance, first significant purchases, different sources of income, MONEY FLOW® & MONEY GROW®

20-34

Family and career building years

Life & disability insurance, college education, buying a house, property & umbrella insurance, starting a business, estate planning, MONEY GROW & MONEY PRO®

34-44

Late career years

Pay off mortgage, investment and retirement accounts review, long term care insurance, MONEY GROW & MONEY PRO®

45-55

Pre-retirement years

Pay off mortgage, investment and retirement accounts review, planning for health costs, MONEY GROW & MONEY PRO®

56-66

Retirement years

Tax management, investments review, MONEY PRO®

67+

How MONEY affects our lives

Emotional

PERSONAL WELLNESS

Intellectual

Financial

Physical

Social

Professional

Spiritual

Environmental

Everything is connected

MONEY FLOW ®

Financial dimension of our personal wellness

- Managing our resources to live within our means

- Set realistic goals

- Prepare for short- and long-term needs

- Make informed financial decisions

- Prepare for emergencies

- Make informed investments

MONEY FLOW®

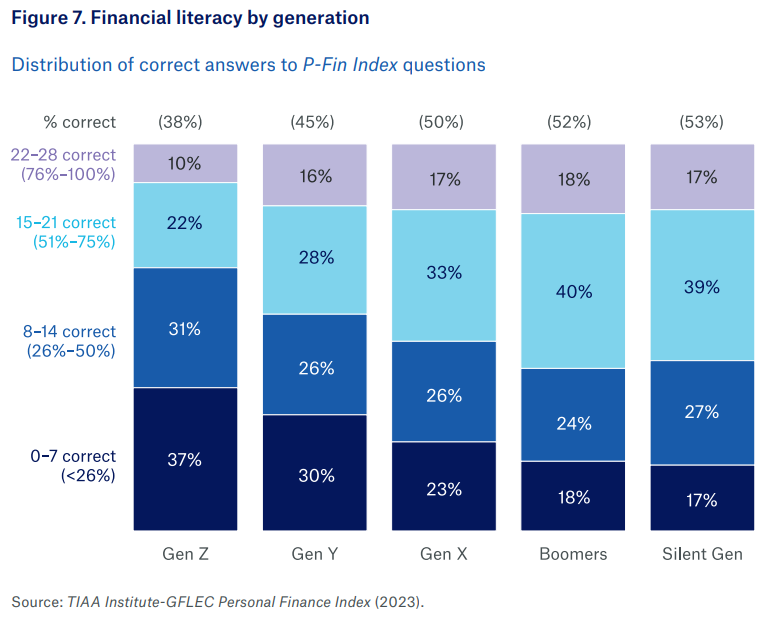

Some statistics

Gen Alpha: 2012-2024

Gen Z o “zoomers”: 1997-2012

Gen Y o “millennials”: 1981-1996

Gen X : 1965-1980

Boomers: 1946-1964

Silent Gen: 1928-1945

MONEY FLOW ®

The problem of financial illiteracy

Financial illiteracy is “the lack of skill and knowledge about financial matters to confidently take effective actions to achieve an individual's personal, family, and community goals.”

Source: National Council of Financial Educators

Problems caused by financial illiteracy:

- We do not understand or appreciate the value of money.

- We do not realize that when we make decisions influenced by our emotions or our mood, the expenses we make are not aligned with our budget, values and objectives.

- We make decisions that gratify us in the short term and have negative consequences in the long term.

- We spend more than our budget allows.

- We assume unsustainable debts.

- We do not save enough for our retirement.

- We make bad investment decisions.

- We do not fulfill our dreams and life goals.

- Stress

- Health problems

- Divorce

- Bankruptcy

- Property losses

- Foreclosures

- Unhappiness

The way we manage our resources affects our lives, our families, our communities and the world.

MONEY FLOW ®

Why do I need my

Financial plan?

To obtain personal wellness

To ensure that my relationships are not affected by money issues

To be prepared for unexpected events

To achieve my life goals

MONEY FLOW ®

MY Financial Plan:

ABC

5 RUles

WHAT IS MY CURRENT FINANCIAL SITUATION?

HOW DO I ENVISION MY FUTURE?

MY FINANCIAL GOALS

Everything is connected

WHAT IS MY

FINANCIAL

PLAN

MONEY FLOW ®

The ABC of our Personal Finances

C

I COMMIT to adopting positive financial habits to implement my financial plan and achieve my goals.

A

I am AWARE of my personal financial situation and of the world around me.

B

I desire to achieve prosperity and personal wellness, and

I BELIEVE that

I will.

MONEY FLOW ®

Rule #1

YOU DECIDE WHERE

YOUR MONEY GOES!

MONEY FLOW®

Rule #2

SOMETHING’S GOTTA GIVE

MONEY FLOW®

Rule #4

KEEP IT SIMPLE

ABC

Prosperity mindset

for me

and my family

(my why)

5 Money FLOW

rules

Everything is connected

MONEY FLOW ®

MY Financial Plan:

5 steps

MONEY FLOW ®

Step #1

My Financial Goals

MONEY FLOW ®

MY FINACIAL GOALS

S

SPECIFIC

What is my specific goal? Why is it important that I achieve it? Define what, how, when, and who is needed to achieve your goal.

M

MEASURABLE

How much money do I need to reach my goal? Define your goal in a way that you can track your progress and know when you succeeded.

A

ACHIEVABLE

What steps do I need to take to reach my goal? Make sure your goal is realistic and aligned with your resources and capabilities. How can I make my goal achievable? It might be challenging, but not impossible.

R

RELEVANT

Is my goal aligned with my values and my present circumstances? Why is this goal important to me? Create a goal that will have a positive impact in your life.

T

TIME FRAME

When do I want to achieve my goal? Setting a deadline for achieving each goal will encourage you to plan accordingly and follow through.

Writing your SMART goals down sets you up to be exponentially more successful

MONEY FLOW ®

Examples of SMART financial goals

SPECIFIC: I want to buy a house

MEASURABLE: I will buy a house that costs $120,000, and save money for a 20% down payment: $24,000.

ACHIEVABLE: I will save $1,000 a month by cutting discretionary spending, and looking for ways to increase my income.

RELEVANT: Homeownership is important for my family and me.

TIME FRAME: 2 years

- Planning my MONEY FLOW

- Paying off credit card debt

- Budgeting to create an emergency fund

- Planning for retirement

- Improving my credit score

- Saving for my children’s education

- Saving for the down payment on a home

- Developing skills to improve my income

- Going on vacation, purchasing a car or other large items

- Starting a new business

MONEY FLOW ®

My Financial Goals

Activity

Example

3

2

1

To buy a house

Specific

S

My budget is $120,000. I will save $24,000 for a down payment

Measurable

M

I will save $1,000 every month

Achievable

A

I want to become a homeowner

Relevant

R

Time frame

2 years

T

MONEY FLOW ®

My Financial Goals

Activity

Example

3

2

1

To create a monthly budget to save money for an emergency fund

Specific

S

I will start with a $6,000 emergency fund.

Measurable

M

I will save $250 monthly

Achievable

A

I want to be financially ready for an emergency

Relevant

R

Time frame

2 years

T

MONEY FLOW ®

Step #2

My Financial Situation

MONEY FLOW ®:

My Financial Situation: I am aware

3 Components of my financial situation

- My net worth:

What I own & what I owe

2. My debt and my credit profile

Credit history & score

3. My income & expenses:

What I earn and what I spend

(Checking and Savings, Money Market, CDs)

MONEY FLOW ®:

My Financial Situation

Ca | |

mm | |

Other | |

Assets

Liabilities

Cash

Real Estate Mortgages

Bank Accounts

(Checking and Savings, Money Market, CDs)

Auto Loans

Investments

HELOC: Home Equity Line of Credit

Retirement Accounts

Business Loans

Life Insurance cash value

Personal Loans

Business Interests or Partnerships

Student Loans

Personal Property

Credit Card Debt

Other Real Estate

Medical Debt

Automobiles

Loan taken from a retirement account

Other assets:

(Jewelry, artwork, cars, gold coins, collector’s items)

Income Taxes

MONEY FLOW ®:

My Net Worth

Activity

My Financial Situation

Assets

$

$

Cash

Checking Account

Savings Account

Investment Account

Retirement Account

Life Insurance

Businesses

Personal Residence

Vacation Home

Investment Properties

Other assets: Jewelry, artwork, arte, gold coins, collectors items)

Automobiles

Total Assets (A)

Real Estate Mortgages

Auto Loans

HELOC

Business Loans

Personal Loans

Student Loans

Credit card Debt

Medical Debt

Loan taken from a retierement account

Income Taxes

Other loans

Other loans

Total Liabilities (L)

MONEY FLOW ®:

My Financial Situation

My Net Worth

Activity

My Net Worth

$

TOTAL ASSETS (A)

- TOTAL LIABILITIES(L)

(ASSETS MINUS LIABILITIES)

= NET WORTH

MONEY FLOW ®:

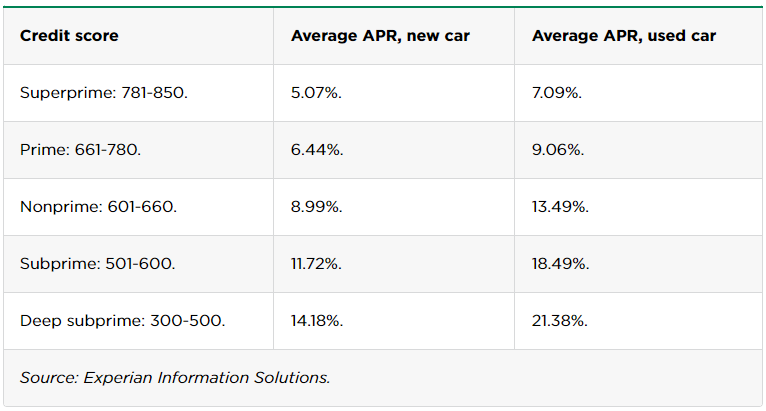

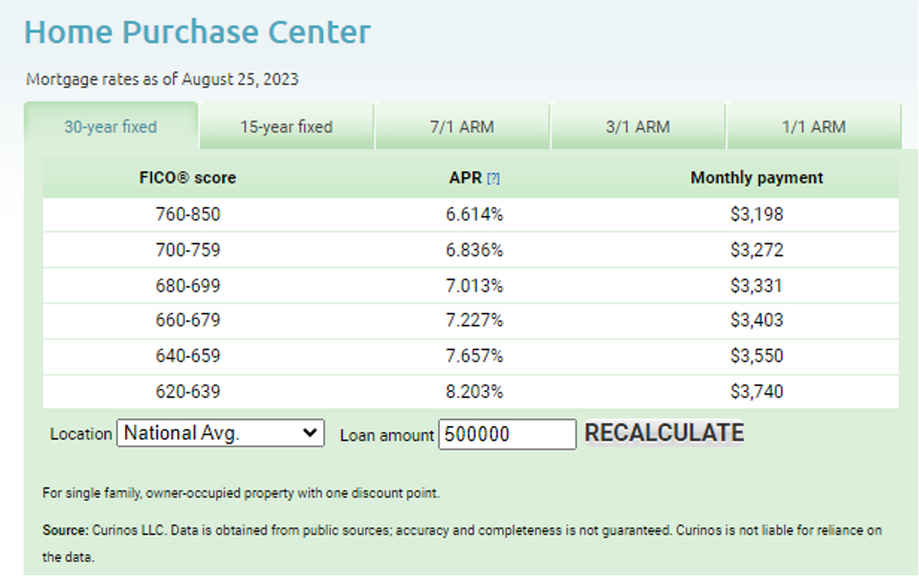

My Debt

Type of Debt | ¿Secured? | ¿Revolving? | Open or Closed end Credit | Risk Level | APR | Comments |

Mortgage | Yes | No | CLOSED | Low | 7.5%-8% | |

Home Equity Lines of Credit -HELOC | Yes | Yes | OPEN | High | 9%-11% | |

Auto Loans | Yes | No | CLOSED | Medium | 5.5%-14% | |

Personal Loans | No | No | CLOSED | High | 8%-25% | |

Student Loans | No | No | CLOSED | Medium | 4.5%-17% | |

Credit Card Debt | No | Yes | OPEN | Very High | 20%-30% |

Monthly Payments: : Pay principal and interest at a relatively low rate for a defined period of time. Interest is tax deductible..

Monthly payments: Pay interest at higher rates than mortgages. It may have an interest-only payment period. It may not be tax deductible.

Monthly payments: Pay principal and interest at a rate that varies based on your credit score over a defined period of time. It may be tax-deductible if used for work purposes.

Monthly payments: Pay the principal and interest at high rates

The loan may be too high for the income level.

The monthly payment can vary. Very high interest rates.

MONEY FLOW ®

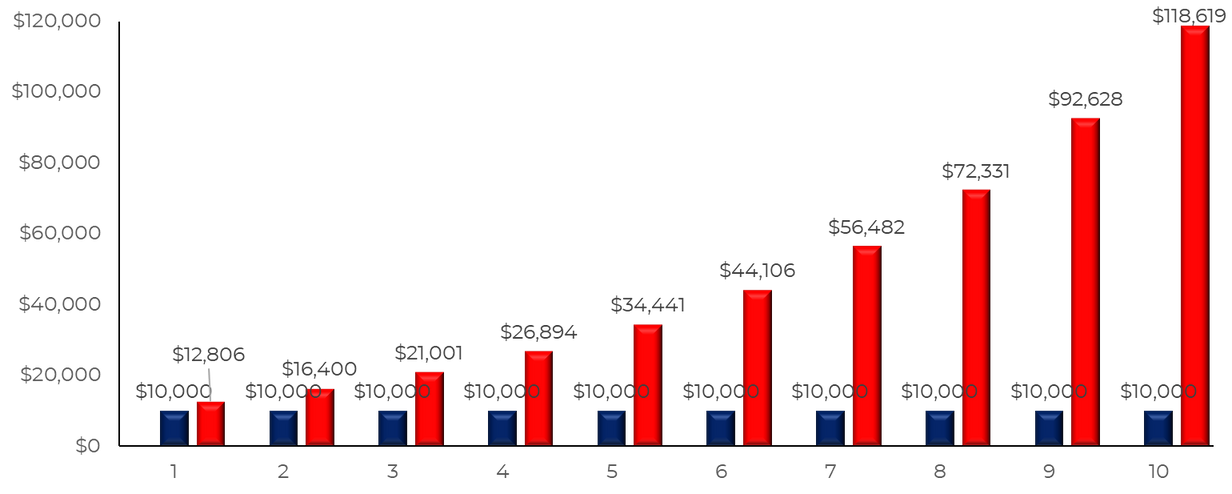

The effect of bad debt in time

Example:

Initial debt: $10,000

Annual Interest Rate: 25%

Time: 10 years

Monthly compounding

Final Value of Debt: $118,619

MONEY FLOW ®

Debt Reduction Plan

1. Stop using your credit cards if you have high balances

2. Assess your debt load: Log into your loan and credit card accounts and gather this information: remaining balance, monthly payment, interest rate

3. Develop your personal debt reduction plan and set debt priorities

4. Analyze your budget: Cut unnecessary expenses and reduce living expenses as much as possible.

Determine available cash.

GOALS

- To become debt-free as soon as possible

- To commit to a plan

- To avoid getting into high-risk debt ever again

MONEY FLOW ®

Debt Reduction Plan

Negotiate a payment plan and an interest rate reduction with creditors

1

Transfer the balance of your credit card(s) to another card with a 0% introductory interest rate for some period of time (transfer fees may apply). Have a clear plan in place for paying off the total balance before the 0% promotional rate expires. PAY ON TIME.

2

and / or

Consolidate your debts by taking out a new personal loan or a line of credit against your assets. Consider interest rates, term, minimum payments.

PAY ON TIME.

(least preferred)

3

Create a DEBT PAYMENT PLAN: 2 methodologies:

4

I.

II.

AVALANCHE

SNOWBALL

MONEY FLOW ®:

Debt Reduction Plan

Avalanche

- List all your debts by higher to lower interest rate.

- Calculate the minimum payment for each debt.

- Pay as much as your budget allows towards the debt with the highest interest rate.

- Continue to pay minimum payment on other debt ON TIME.

- When the highest interest rate debt is paid off, move on to paying extra towards the second highest interest rate debt.

- Continue until all debts are paid off.

Snowball

Cuotas mensuales: Paga capital e intereses a una tasa que varía por puntaje de crédito en un período de tiempo definido. Puede ser deduciblede impuestos si se utiliza para el trabajo.

- List all your debts by lowest to highest balance owed.

- Calculate the minimum payment for each debt.

- Pay as much as your budget allows towards the debt with the lowest balance.

- Continue to pay minimum payment on other debt ON TIME.

- When the smallest balance debt is paid off, move on to paying extra towards the one with the next smallest balance.

- Continue until all your debts are paid off.

Cuotas mensuales: Paga capital e intereses a una tasa relativamente baja por un período de tiempo definido. Los intereses son deducibles de impuestos.

Cuotas mensuales: Paga intereses a tasas más altas que las hipotecas. Puede tener período de pago de intereses solamente. Puede no ser deducible de impuestos.

Cuotas mensuales: Paga el capital y los intereses a tasas altas.

El préstamo puede ser demasiado alto para el nivel de ingresos.

El pago mensual puede variar. Tasas muy altas.

Two Methodologies

MONEY FLOW ®:

Debt Reduction Plan

Type of Debt

Bank/Creditor

Amount Owed

Interest Rate

Maturity

Activity

Comments

MONEY FLOW ®

My Credit Profile

Your credit profile is made up of your CREDIT HISTORY and your CREDIT SCORE.

Your Credit History:

- Companies with whom you have loans provide your information to Credit bureaus, who create your credit history.

- Your Credit History describes how you use money:

- How many credit cards do you have?

- How many loans do you have?

- Do you pay your bills on time?

- What debt balances do you have?

Credit Bureaus:

- They create a credit report, with details of all your loans for the past seven to ten years.

- They provide your credit reports to lenders and creditors to help them determine your creditworthiness.

- They provide your Credit reports to you, so you can better understand your credit situation.

- They provide your credit report to two credit scoring companies to generate your credit score.

MONEY FLOW ®

My Credit Profile

Activity: Request your credit report

Credit Report:

It is a summary of your credit history that lists:

- your name, address, and Social Security number.

- your credit cards.

- your loans.

- how much money you owe.

- if you pay your bills on time or late.

Benefits of Credit:

By law, you can get a free credit report each year from the three credit reporting agencies (CRAs):

AnnualCreditReport.com is the only website authorized by the federal government to issue free, annual credit reports from the three CRAs.

Your Credit Score:

- There are two main credit scoring companies:

- A credit score is a three-digit number designed to predict how likely you are to pay back a loan on time, based on:

- Your payment habits

- The amount of debt you have

- Creditors and lenders consider your credit score when deciding whether to approve you for a new loan.

- Your credit score impacts the interest rate and other terms on any loan or other credit account for which you qualify.

Consequences of Credit:

MONEY FLOW ®

My Credit Profile

ACTIVITY

- The factors that make the biggest impact on your score are:

- Paying on time

- Credit utilization or amount of available credit

- Length of credit history

- New credit accounts

- Types of credit

- To establish a lengthy and good credit history:

- Pay on time.

- Keeping your utilization below 30%

- Keep older accounts open.

Source: National Financial Educators Council

MONEY FLOW ®

Why is my credit profile important?

- Building and maintaining a good credit rating has a positive impact on your financial future.

- Good credit increases the probability that you will be approved for a new loan that you might need to achieve your financial goals.

- Good credit will qualify you for better loan terms, saving you money over time.

Example 1

MONEY FLOW ®

Why is my credit profile important?

Example 2

Source: www.myfico.com

+$542 monthly

+$195,120

in 30 years

at a 0% interest rate

+$544,447

in 30 years

at a 6% annual interest rate

MONEY FLOW ®:

Good practice to keep a good credit profile

Keep debts to a minimum

Build, repair, and maintain a good credit score

Pay your bills on time (set up automatic payments)

Keep inquiries to what is strictly needed

Check in detail your information on your credit report for signs of identity theft

COMMIT to review your credit score monthly and your credit report annually

MONEY FLOW ®:

My financial situation: My Income and Expenses

My Income

Salary

Bonus & commissions

Tips

Retirement income

Passive income:

Rental income

Dividends

Interest

Business income

Other

My Expenses

Fixed

Mortgage or rent

Auto: Loan or lease

Other debt payments

Auto insurance

Medical insurance

Property insurance

Home maintenance

Taxes: Income, social security, property

My Expenses

Variable

Food

Transportation: gas, registration

Utilities: Gas & electricity

Clothing

Medical expenses

Entertaining

Gifts

Other

Utilities: Phone, cable, internet

INCOME – EXPENSES =

CHANGE IN MY CASH OR DEBT POSITION ~ CHANGE IN MY NET WORTH

MONEY FLOW ®:

TOTAL INCOME

Income

Clothing | |||||

Utilities/Cel |

Salary

Bonuses & Commissions

Wages

Retirement income

Passive income:

Rent

Dividends

Interest

Business

Other income

Mortgage or rent

Car payments: loan or lease

Other loan payments

Health Insurance

Car Insurance

Property insurance

Home maintenance /Condo fees

Income taxes

Property taxes

Other fees or taxes

Other debt payments

Car expenses: Gas, repairs, parking

Groceries

Medical bills

Entertainment

Gifts

Account Fees/Late fees/Overdraft

Health & Fitness

Pets

TOTAL EXPENSES

$

My Cash Flow

Fixed Expenses

$

Activity

Other

Expenses

$

MONEY FLOW ®

Step #3

My Budget

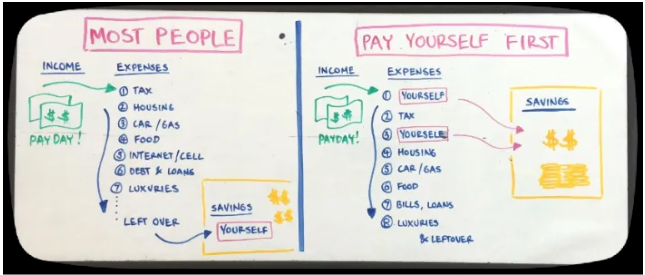

MONEY FLOW ®:

#3 Donations

#2 Spending

#1 Savings and investments

THREE WAYS I CAN USE my money

MONEY FLOW ®

How I use my money

ACTIVITY

- I align it to my values, needs, goals and dreams – this is my WHY

- I choose the tool I will use: Notebook, Excel, Mint, Quicken - this is my HOW

- I determine how much I owe, and how much I can save - WHAT

- I establish how much my living expenses should be: housing, transportation, groceries, and other

- I decide how much money I can/want to donate

MONEY FLOW ®

Savings & Investments

Savings

Emergency Fund – 6-12 months of fixed expenses

Retirement – 5-10%

Goals– 5-10%

MONEY FLOW ®:

Savings & Investments

Emergency Fund

Example

My Monthly Fixed Expenses

Minimum

Security:

6-12 months of fixed expenses

Peace of mind:

24-36 months of fixed expenses

$4,000*

$1,000

$24,000 - $48,000

$96,000-$144,000

* Housing, food, transportation, insurance

Tips:

- If you don’t have any emergency savings, split your monthly savings between retirement savings and emergency savings until you have at least 6 months of fixed expenses saved.

- Once you are done funding your Emergency Savings, maximize your contributions to your Retirement Savings and start investing for your SMART goals.

MONEY FLOW ®:

Savings & Investments

Retirement Savings

My Monthly Gross Income (before taxes and deductions)

5%

$5,000

$250

10%

$500

SAVINGS FOR MY GOALS / DREAMS

$4,000

My Monthly Net Income (After taxes and deductions)

5%

10%

$200

$400

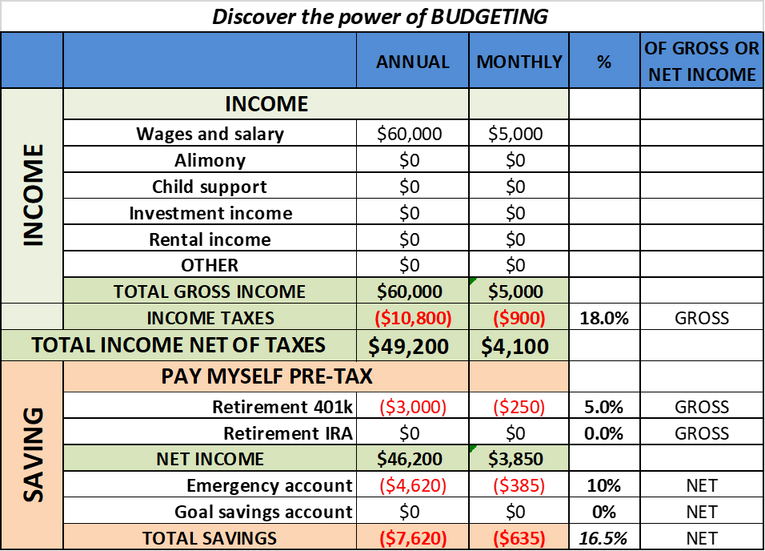

MONEY FLOW ®

Savings & Investments: How Much Should I Save

ExamPle

Annual Gross Income $60,000

Monthly Gross Income $5,000

401k Contribution* 5%

Effective Tax Rate 18%

Monthly Net Income $3,895

Additional savings - 10% of net income $390

Monthly retirement savings + additional $890

Annual Interest Rate 7.2%

Number of years 10

Number or periods 120 months

Future Value $155,753

If you are 23 years old, at your retirement age of 67 you would have saved for 44 years:

Number of Periods 528 months

Future Value $3,342,849

I Pay Myself first

* 401K: Contribute enough to make the maximum match

MONEY FLOW ®:

Savings & Investments: I pay myself first

%

Gross Net

Total Income (TI)

%

rule of thumb 28/36 – CONVENTIONAL MORTGAGE

MONEY FLOW ®:

Spending: How much should I spend in housing?

• Individuals should not spend more than 28% of their gross income for monthly payments associated with their home: Principal and interest payments, insurance, property taxes, and any association dues.

• 4 parts of your monthly mortgage Payment: PITI - Principal, interest, taxes and insurance.

• Individuals should not spend more that 36% of their gross income for expenses associated with their homes in addition to other debt payments such as credit cards and student or car loans.

Example

Gross Income

28% PITI

36% PITI + other expenses

Annual

$60,000

$16,800

$21,600

Monthly

$5,000

$1,400

$1,800

MONEY FLOW ®:

Spending: How much should I spend in housing?

rule of thumb 31/43 – fha LOANS

–Federal Housing Adminstration

• Individuals should not spend more than 31% of their gross income for monthly payments associated with their home: Principal and interest payments, insurance, property taxes, and any association dues and rent if applicable.

• Individuals should not spend more that 43% of their gross income for expenses associated with their homes in addition to other debt payments such as credit cards and student or car loans.

• An FHA loan is a type of mortgage geared toward borrowers with lower credit scores, or who otherwise do not qualify for a conventional loan. They require a lower down payments.

• FHA loan borrowers who put less than 20% down on their home purchase are responsible for paying two mortgage insurance premiums: upfront and annual (MIP – Mortgage Insurance Premium).

Example

Gross Income

31% PITI

43% PITI + other debt payments

Annual

$60,000

$18,600

$25,800

$5,000

$1,550

$2,150

MONEY FLOW ®:

Spending: How much should I spend in my car?

the 20 / 4 / 10 rule

- 20 % Down - We pay down at least 20% of the total purchase price.

- 4-year loan - We need to be able to pay off the balance in 48 months or less.

- 10% of your income - your total monthly auto costs should not be more than 10% of your monthly gross income - 15%-20% of net income

- Car expenses include:

- Car loan or lease

- Insurance

- Gas

- Maintenance

- Registration

- Taxes

- Repairs

- Service

Monthly

Annual

Example

Gross Income

$60,000

$5,000

10%

$6,000

$500

MONEY FLOW ®:

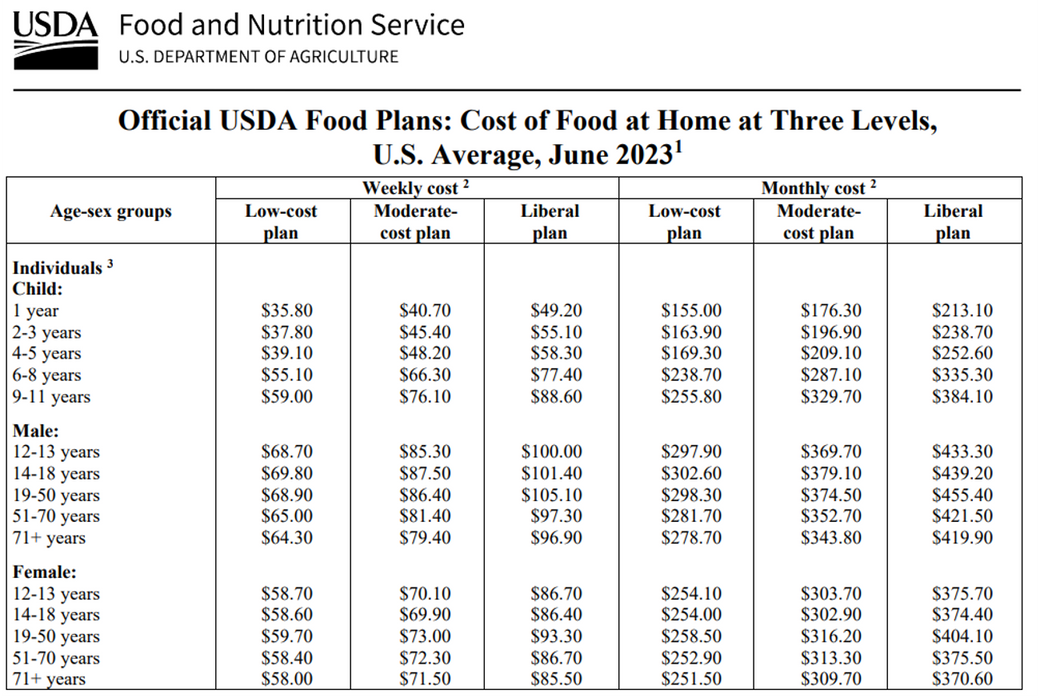

Spending: How much should I spend in groceries?

Example: Family of 4

26 year old man

63 year old man

22 year old woman

56 year old woman

TOTAL MONTHLY COST MODERATE PLAN: $1,356.70

WEEKLY (4.5 weeks): $301.50

MONEY FLOW ®:

Spending: Sample Budget

Activity: Excel spreadsheet

MONEY FLOW®:

Spending: My budget

TOTAL INCOME (TI) |

INCOME

ANNUAL

MONTHLY

Salary

Other Income

ACTIVITY

Pay myself first: First Payment

Annual

Monthly

%

Gross Net

Retirement Account

Taxes

First Payment Total

Net Income (NI)

Pay myself first: Second Payment

Annual

Monthly

%

Gross Net

Retirement Account

Taxes

Second Payment Total

Net Income (NI)

MONEY FLOW®:

Spending: My budget

Annual

Monthly

%

Gross/ Net

DEBT REDUCTION

Credit Cards

Other

Total

Debt Reduction

CHARITY

Annual

Monthly

%

Gross/ Net

DONATIONS

FIXED EXPENSES

Annual

Groceries

Housing

Health Insurance

Utilities

Monthly

%

Gross/ Net

Personal Care

TOTAL FIXED EXPENSES

Transportation

TOTAL EXPENSES

(TE)

Annual

Monthly

VARIABLE EXPENSES

Annual

Monthly

%

Gross / Net

Entertainment

Clothing

Other

TOTAL VARIABLE EXPENSES

Activity

NET INCOME - TOTAL EXPENSES |

NET BALANCE

Annual

Monthly

MONEY FLOW ®:

Spending: Ways to save

- Think twice before making an impulsive purchase. Does it align with your life goals? Does it get you closer to your financial goals, or further away?

- Remove the Amazon app from your phone.

- When shopping online, keep your items in the cart for 24/48 hours. You will probably empty the cart 90% of the time.

- Before going to CVS or Target, make a list and stick to it.

- Reduce coffee shop visits.

- Reduce dining out and ordering food.

- Remove saved credit cards from online stores.

- Use everything in your freezer and refrigerator before grocery shopping.

- Make a weekly menu and a grocery shopping list.

- Purchase important items on discount.

- Buy generic brands.

- Do not buy bottled water.

- Reduce fixed expenses.

- Buy essential cleaning products/school supplies at the Dollar Store.

- Switch to LED bulbs.

- Lower the thermostat.

Ways to save

MONEY FLOW®:

Donations

TALENT

Choose a good cause to support

Share your 3 Ts

TIME

TREASURE

Giving!

MONEY FLOW®:

Donations

“What is the meaning of success?

…To know that even one life has breathed easier because you have lived…”

Ralph Waldo Emerson

MONEY FLOW®:

Donations

why

It changes lives

Gives a deep sense of purpose

It has an impact on the world

It impacts your family and your community

It impacts your work

It is tax deductible

MONEY FLOW®:

Donations

Elderly

Orphaned Children

Illnesses

Nutrition

Education

Poverty

Women

SOME CAUSES

Infrastructure projects in impoverished areas

Housing construction

Entrepreneurship

Shelters for displaced people

Human Trafficking

Animal Shelters

MONEY FLOW ®

Step #4

A SIMPLE PLAN

MONEY FLOW®: A SIMPLE PLAN

SIMPLIFY

CHOOSE 2 BANK ACCOUNTS

CHOOSE 1 - 2 CREDIT CARDS

CHOOSE 1 - 3 INVESTMENT ACCOUNTS

MONEY FLOW®: A SIMPLE PLAN

CHOOSE 2

BANK ACCOUNTS

CHECKING ACCOUNT FOR MONTHLY EXPENSES/PAYMENTS

SAVINGS OR money market ACCOUNT FOR EMERGENCY SAVINGS

CHOOSE 1-2

CREDIT CARDS

- NEEDS

- WANTS

GOLDEN RULES

- SET YOUR MONTHLY SPENDING LIMIT

- PAY OFF EVERY MONTH

WHAT TO LOOK FOR

- INTEREST RATES

- CREDIT LIMIT

- PENALTIES AND FEES

- BENEFITS: AIRLINE MILES/POINTS, CASHBACK, DISCOUNTS, GAS, GROCERIES, HOTEL AND TRAVEL POINTS

CHOOSE 1-3

INVESTMENT ACCOUNTS

- SPARE CHANGE ACCOUNT (ACORNS)

- RETIREMENT ACCOUNT (MONEY GROW)

- INVESTMENT ACCOUNTS TO MEET OUR GOALS (MONEY GROW)

** WWW.ACORNS.COM

MONEY FLOW ®

Step #5

AUTOMATE

MONEY FLOW®: AUTOMATE

SETUP DIRECT DEPOSITS, AUTO BILL PAY, AND AUTOMATIC TRANSFERS

SAlary, wages, commissions/other income

1. Fund pre-tax RETIRement account (401k, IRA, HSA, OTHER)

2. transfer to the following accounts:

taxes (if applicable), emergency savings, Investments

3. credit card payments

4. bill payments

5. DONAtIONS

MONEY FLOW®

MY COMMITMENT

MONEY FLOW ®:

COMMITMENT

ONE HOUR A WEEK - MY COMMITMENT

THERE ARE 7 DAYS, 24 HOURS A DAY, A TOTAL OF 168 HOURS IN A WEEK.

100%

WE WORK 5 daYs, 8 hoUrs A dAY, A total OF 40 hoUrs A WEEK

24%

33%

WE SLEEP 8 hoUrs A DAY, 7 DAYS, A TOTAL OF 56 HOURS A WEEK

43%

WE STILL HAVE 72 HOURS A WEEK, OR 10 HOURS A DAY

0.6%

ONE HOUR A WEEK CAN CHANGE YOUR LIFE

Activity

Day: ____________________

Time: ___________________

How: ___________________

Where: _________________

With whom: ____________

MONEY FLOW®:

SMART HABITS

The Power of Habit contains an STIMULATING argument:

The key to exercising regularly, losing weight, raising exceptional children, becoming more productive, building revolutionary companies and social movements, and achieving success is understanding how habits work.

Habits are NOt destiny.

As Charles Duhigg shows, by harnessing this new science, we can transform our businesses, our communities, and our lives.

SMART HABITS

MONEY FLOW®:

SMART HABITS

NEVER FIGHT OVER MONEY - IT IS NOT WORTH IT!

ONE HOUR A WEEK:

CREATE THE HABIT!

AUTOMATE ALL YOUR PAYMENTS AND NEVER BE LATE

PAY YOUR MORTGAGE AND OTHER DEBTS EVERY TWO WEEKS IF POSSIBLE

PAY YOUR CREDIT CARD BALANCES EVERY MONTH

SET A LIMIT FOR YOUR “WANTS” SPENDING

SPEND LESS THAN YOU EARN

KEEP YOUR CAR AS LONG AS POSSIBLE

AVOID IMPULSE BUYING

INVITE FRIENDS OVER INSTEAD OF GOING OUT

INVEST EVERY DOLLAR YOU CAN

TRULY UNDERSTAND WHERE YOU ARE INVESTED

CHOOSE A FINANCIAL ADVISOR OR MENTOR THAT YOU TRUST

CREATE AS MANY SOURCES OF INCOME AS YOU CAN

MAXIMIZE YOUR 401k CONTRIBUTION

GET TO WORK EARLY

BE AWARE OF ALL THE DIMENSIONS OF YOUR PERSONAL WELLNESS

SHARE YOUR 3TS: TALENT, TIME AND TREASURE

REMAMBER THE ABC AND 5 RULES OF YOUR FINANCIAL PLAN

NEVER FORGET YOUR BIG WHY

“EARLY TO BED, EARLY TO RISE, MAKES A MAN HEALTHY, WEALTHY AND WISE” - BENJAMIN FRANKLIN

MONEY FLOW ®

CONCLUSIONS

MONEY FLOW®: 3 WAYS i CAN USE MY MONEY

#3 Donations

#2 Spending

#1 Savings & Investments

I PAY MYSELF FIRST

SHARE YOUR 3Ts

RETIREMENT ACCOUNTS: 5% OFMY GROSS INCOME (Befores taxes and deductions)

SAVINGS AND INVESTMENT ACCOUNTS: 10% - 15% OF MY NET INCOME (after taxes and deductions)

10%

15-20%

NEEDS

WANTS

70%

10% OF MY NET INCOME

60% OF MY NET INCOME

MONEY FLOW®

MY BUDGET

MY FINANCIAL SITUATION

my financial goals

60% NEEDS

10% WANTS

20% SAVINGS/paying off debt

10% DonaTIONS - THE 3 TS

SMART

MY NET WORTH

MY CASH FLOW

CREDIT REPORT

a simple plan

1 checking & 1 savings account

1-2 credit cards

2-3 investment accounts

automate

- transfers to RETIREMENT ACCOUNT

- transfers to INVESTMENT ACCOUNTS

- transfers to emergency savings account

- credit card payments

- utilities/bill payments

- donations

your commitment

one hour a week

COMMIT TO YOUR PLAN!

MONEY FLOW®: MY FINANCIAL PLAN

MONEY FLOW®

MONEY GROW®

MONEY PRO®

#3 DONATIONS

#2 SPENDING

#1 SAVINGS AND INVESTMENTS

ABC

5 RULES

5 STEPS

Be Aware

believe

commit

- YOU RULE!

- SOMETHING’S GOTTA GIVE

- EVERY PENNY COUNTS!

- keep it simple

- make a COMMITment

- ESTABLISH MY FINANCIAL GOALS

- EVALUATE my CURRENT financial situation

- create my budget:

- PLAN SAVINGS AND INVESTMENTS #1

- PLAN EXPENSES #2

- PLAN DONATIONS #3

- SIMPLIFY

- AUTOMATE

HOMEWORK

THURSDAY, NOVEMBER 2, 2023

- Continue thinking about your financial goals, values and priorities in your life.

- Determine your net worth and cash flow in detail.

- Decide which tool you will use to create your budget:

- Quicken, Mint, Excel, notebook, or other application.

- Create your ideal budget.

- Identify your debt and decide what debt reduction strategy you will use, if needed.

- Decide whether you want to donate, how much, and choose a cause that aligns with your values.

- Simplify your financies using few accounts and credit cards.

- Automate all payments and transfers as possible.

- Schedule the day/time of the week you will commit to review and update your financial plan - set an alarm on your phone until it becomes a habit.

MAXIMIZE YOUR TALENTS!

FOLLOW UP ON YOUR FINANCIAL PLAN

CREATE HABITS TO ACHIEVE RESULTS

MONEY FLOW®

ADDENDUM

- Different types of bank accounts

- Considerations when planning to start a family

- Benefits of buying vs. renting a house

- Types of mortgages

- Benefits of buying vs. renting a vehicle

MONEY FLOW®: DIFFERENTS TYPES OF BANK ACCOUNTS

CHECKING ACCOUNT

- use it as a distribution center: to receive your income and automatically allocate it among your expenses, savings and donations

- you WILL NOT earn interest - do NOt leave too much money here

- banks typically require a monthly minimum to avoid maintenance fees

- it usually offers unlimited checks

- choose a bank with convenient ATm locations

SAVINGS ACCOUNT

- use it for your emergency fundS

- it HAS A limited monthly usage, typically 6 withdrawals

- IT MAY have a minimum balance requirement

- pays you interest (some do nOt)

- GENERALLY, it does nOt charge fees

- it must be insured by the FDIC

MONEY FLOW ®: DIFFERENTS TYPES OF BANK ACCOUNTS

money market account

- Use it for your emergency fundS

- it may have a monthly usage restriction

- it may have a high minimum balance requirement.

- it earns more interest

- GENERALLY, fees are not charged

- GENERALLY, not backed by the FDIC

FDIC

- The Federal Deposit Insurance Corporation (FDIC) is an independent agency created by the Congress to maintain stability and public confidence in the nation’s financial system. The FDIC insures deposits; examines and supervises financial institutions for safety, soundness, and consumer protection; makes large and complex financial institutions resolvable; and manages receiverships.

- The FDIC insures $250,000 per depositor, per bank, per account category of ownership

MONEY FLOW®:

IMPORTANT QUESTIONS WHEN PLANNING FOR A FAMILY

- What financial situation does each of us have? What is our credit rating?

- Do we need to plan a wedding? How much will it cost us?

- Are we both working? Are we going to join our financial lives?

- Assets and Liabilities

- Budget

- Taxes

- Dreams and goals

- Where do we want to live?

- What type of house would we like to have?

- Are we going to buy or rent a house?

- Are we going to have children?

- How many would we like?

- When we have children, will one of us stay at home taking care of them?

- What kind of school will we take our children to? Private or public?

11.Are we going to send our children to University? What type, private or public?

12. When are we going to start saving for our children's education?

13. What financial values will we teach our children? What examples do we want to give them?

14. Are we going to learn about managing our finances together?

15. Is one of the two going to lead the family finances?16. Who is going to pay the bills every month?

17. How much are we going to spend, save, donate?

18. Are we going to buy life insurance policies?

19. What type of health insurance are we going to have?20. How are we going to divide the housework?

21. Are we going to have a prenuptial agreement?

22. Are we going to give our children a religious education?

MONEY FLOW®: SHOULD WE BUY OR RENT A HOME?

TENANT

HOMEOWNER

INITIAL FUNDS NEEDED

GENERALLY 3 MONTHS OF RENT

Down payment, at least 20% of the purchase cost plus closing costs, 2-4% of the property value

UTILITIES

VARIABLE

YES

MAINTENANCE & REPAIRS

NO

YES

PROPERTY TAXES

NO

YES

HOME INSURANCE

NO

Y

TENANT INSURANCE

YES

NO

LONG TERM COMMITMENT?

NO

NO

RISKS

INCREASE IN RENT OR CANCELLATION

Increase in interest rates if the mortgage is variable. Decrease in market value of the property.

TERM COMMITMENT

SHORT

LONG

HOUSEWORK

MODERATE

HIGH

MONEY FLOW®:

WHY SHOULD WE BUY A HOME?

YOU CAN FINANCE THE PURCHASE

A HOME CAN BE A FAMILY’S MOST IMPORTANT SAVING VEHICLE

MORTGAGE INTEREST IS DEDUCTIBLE

YOU ARE A HOMEOWNER

REAL ESTATE VALUES GENERALLY GROW IN TIME

iT IS AN ASSET THAT GENERALLY MAY BE TRANSFERRED FROM GENERATION TO GENERATION

“ Real Estate is the best vehicle to increase wealth”

David Bach

MONEY FLOW®: SHOULD WE BUY OR RENT A HOME?

- Consider the pros and cons of buying versus renting a home.

- Determine if you have the financial means to purchase.

- Discover all the expenses involved.

- Decide how much debt you can take on.

- Start your research: House types, sizes, prices, location, trends by area, traffic, parking, schools, plumbing and electrical situation of the house, types of windows and doors, type of fences, security, alarm, roof.

- Get pre-qualified and approved for your mortgage credit: Check your credit score.

- Contact your mortgage broker or bank that provides mortgages.

- Compare mortgage types and interest rates.

- Find the right real estate agent.

- Get Home Inspection and Appraisal.

- Obtain a real estate attorney to close the purchase transaction.

- Review all closing costs.

- Review all closing documentation.

- Keep documentation in a safe, electronic and physical place.

MONEY FLOW ®: TYPES OF MORTGAGES

TYPES OF MORTGAGES

INTEREST RATES

APR

30 YEAR FIXED MORTGAGE RATE - FHA

6.47%

7.38%

30 YEAR FIXED MORTGAGE RATE - VA

6.67%

6.79%

30 YEAR R\FIXED MORTGAGE RATE

7.53%

7.54%

15 YEAR FIXED MORTGAGE RATE

6.79%

6.84%

VARIABLE INTEREST RATE 5/1 ARM

6.56%

6.56%

Examples from Bankrate.com on September 2nd, 2023

FHA: Federal Housing Administration

VA: Veterans Administration

ARM: Adjustable-Rate Mortgage - Interest rate adjusts according to a formula with a spread over a reference rate.

5/1 ARM: Interest rate is fixed for 5 years and then adjusts yearly.

When interest rates are very low, it is suggested to take a long mortgage with fixed interest rate.

When interest rates are high and expected to be lower, it is suggested to take on a variable rate mortgage.

MONEY FLOW ®: ¿BUY OR LEASE A CAR?

PROS for leasing

- GENERALLY, the monthly payment is lower.

- GENERALLY, maintenance costs are lower.

- You can change models frequently.

- They usually have a guaranty

PROS for buying

- You own your car - create equity.

- You can sell your car if you need to.

- You can plan for years without a car payment.

- Payments are limited to the term of the loan

Depending on the type of car and other factors, it is generally more economical to buy in the long run.

How much should I spend in my car? Maximum 15% of my net income

MONEY FLOW ®: ¿BUY OR LEASE A CAR?

example

Gross annual salary: $60,000

Gross monthly salary: $5,000

Net monthly salary: $4,100 (18% effective tax rate)

Maximum you can spend in your car: $615 - $820.

(includes lease or loan, gasoline, insurance, registration, maintenance and repairs.)

monthly expense example

Loan/Lease: $300

Insurance: $100

Gasoline: $150

Registration: $10

Maintenance: $80

Total: $640 (15.6% of my monthly net salary )

Sources::

Dinkytown Car Lease vs Buy

Nerdwallet Car Payment Calculator

Nerdwallet Car Lease Calculator

Omni Calculators

AAA Newsroom

Car depreciation worksheet

MONEY FLOW ®: ¿BUY OR LEASE A CAR?

NEW CARS DEPRECIATE, ON AVERAGE, 20% THE FIRST YEAR AND 10% ANNUALLY THE FOLLOWING YEARS

SOME TIPS FOR BUYING A CAR

- ALWAYS Negotiate the price.

- Mileage: Miles per gallon city and highway.

- Investigate the depreciation rate of the car if purchased.

- Find out the ransom value if rented.

- Find out maintenance and repair costs.

- Tire cost.

- Guarantee cost

- Insurance cost

¡THANK YOU!